For bankers and credit institutions, CRBs (credit reference bureaus) such as metropol crb has brought a bucketful of joy since they can now easily catch notorious defaulters. But for borrowers, CRB has been a mess.

No lender will touch you even with a ten foot pole is you have been listed on the CRB website.

Indeed, you can as well forget about accessing loans in Kenya once reported to the CRB.

What is CRB

A CRB (credit reference bureau) is an independent firm that collects credit information from a multitude of sources and shares such details on individual consumers with interested parties for various uses.

The firms go by various names:

In America, they call them credit bureaus while in the UK, they are credit reference agencies.

In Kenya?

CRB or simply credit reference bureaus and are licensed by the central bank.

Which are the registered CRBs in Kenya?

In Kenya, credit reference services are not that old..the first CRB was licensed around 2009.

That said, we have two dominant agencies In the country;

- Metropol CRB (you can check the out on their metropol website)

- iCredit Info

- Transunion CRB Kenya (Credit Reference Bureau -Africa Limited)

There were others at the start but they disappeared from the radar soon after launch.

Who can list you on CRB?

Now, if you don’t pay your debts, the you should be very worried because practically every other institution can list you.

From saccos, helb, all banks, mshwari, kcb mpesa loan, your employer…name it!

So, if you don’t want to suffer the ignominy of being turned away by creditors at the very last moment on the basis of an adverse CRB listing, contact your creditors- one by one- and clear your name!

Can the CRB information help me access a loan?

Incredibly, you can use your credit report- if you have a healthy score- to negotiate lower interest rates with any lending company.

Actually, if you have an awesome credit score and have never been on the CRB list of defaulters, then you can rest assured that you can easily access an advance from any institution you think of.

Which information can I get from a CRB firm?

Many Kenyans just worry about how to clear with CRB ignoring the fact that there’s a lot of useful details you can obtain from the CRB Kenya.

They include:

-

Credit rating

This is a hypothetical value calculated by applying a certain formula on the borrower’s credit history to determine his

creditworthiness

This score will then be used by banks (and other borrowers) to award and also cost loans. People who pay promptly paying less interest and vice versa.

Metropol awards a score of between 200 and 900 points with those going below 400 regarded as serial defaulters. Conversely, a score of 400 means you are fair so banks can give you a loan though they’re usually very cautious.

A Good credit score is approximately 900 and prompts lenders to advance you cheaper loans.

-

CRB Clearance Certificate

This is a certificate you obtain from either transunion CRB or metropol stating that you don’t have a negative listing on the CRB database.

Unfortunately, since your credit information is updated daily, the certificate is only valid for one day- the day it was issued.

That’s why you see many employers and financial institution rejecting an older CRB report.

That being said, a certificate of clearance will set you back around shs.2200.

-

Credit report

This is the report generated by the CRB Company containing information on an individual’s credit history.

The report will show:

- Identification details (bio data name, ID, marital status, email, Cell phone)

- Employment details

- Credit performance including all non-performing (loans not paid for 90 days) and performing accounts loan accounts plus their default history

- All credit history inquiries

- Bounced cheques (you have issued).

- Proven cases of attempted or actual frauds and forgeries

- Misappropriation of borrowed money

- Receivership, bankruptcy and liquidation

Checking your CRB status on Metropol CRB: Step by step

Stage 1: We commence by registering for the service

- On your phone(safaricom) dial *433# (ensure you have airtime)

- Enter your Kenya national ID card number

- A new prompt comes next asking for agent number. This is what you do:

- If you have been referred by a CRB agent, enter the agent number. If not, enter zero (0).

- Read and confirm your details as displayed to complete the initial registration steps.

- Reply with the right number to confirm.

Stage 2: Paying for registration

- Go to MPESA toolkit on your phone

- Choose lipa na mpesa

- Tap on pay bill

- Tap enter business number and type 220388

- Tap on account number

- Enter Kenya national ID card number as the account number

- Enter amount Ksh 100

- Now enter your MPESA pin

- Read and confirm the details

- An SMS comes to your phone from metropol(Crytobol) with your PIN, Reference Number, and a link.

Stage 3: Getting the credit report- first time

- On your phone, Dial *433#(ensure you have airtime)

- Enter your PIN (or type xxxx to reset your PIN)

- Choose credit report

- Read and confirm by pressing the right number

- The first report is free so just follow the instructions sent via SMS and go to the Metropol website to download it by entering the reference number and mobile number.

For those already registered:

- On your phone, Dial *433#(ensure you have airtime)

- Enter your PIN (or type xxxx to reset your PIN)

- Choose credit report

- Read and confirm the request by pressing the right number

- You will be asked to pay for the credit report…

Paying for the report:

- Go to MPESA toolkit on your phone

- Choose lipa na mpesa

- Tap on pay bill

- Tap enter business number and type 220388

- Tap on account number

- Enter Kenya national ID card number as the account number

- Enter amount Ksh 250

- Now enter your MPESA pin

- Read and confirm the details

- An SMS comes to your phone from metropol(Crytobol) with your PIN, Reference Number, and the all-important link to your credit report.

- Visit Metropol website, type your phone number and the reference number you were issued with to download the credit report.

Other Services On The Metropol crb Website

| Service | Charges |

| Clearance Certificate | Ksh 2200 |

| Credit Score | Ksh 150 |

| Credit Report | Ksh 250 |

| Blacklist Status | Ksh 50 |

| Who Has Blacklisted (you) Me | Ksh 100 |

Remember that you have to make all payments through metropol’s PayBill number 220388 while the Account number is your ID number before trying to access any other service.

Steps To access the other services(including CRB certificate application kenya):

- On your phone, Dial *433#(ensure you have airtime)

- Enter your PIN (or type xxxx to reset your PIN)

- Pick your desired service:

- Listing Status

- Credit Scores

- Credit report

- Clearance Certificate

- Who listed me

- An SMS comes to your phone from metropol crb (Crytobol) with your PIN, Reference Number, and the all-important link to your credit report

- Visit Metropol website, type your phone number and the reference number you were issued with to download the requesated report.

To get help:

If you are stuck, don’t hesitate to call metropol CRB kenya contacts on 0709 834 000.

Checking your CRB check online kenya on TransUnion CRB: Step by step

For TransUnion CRB services, you have several options:

- use SMS number 21272

- via the TranUnion Nipashe app

- Go through TransUnion website.

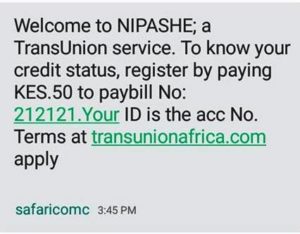

Stage 1: Registering for the Transunion CRB service from the phone

- Send your three names to 21272(you will need enough airtime- at least 20/=)..

- You will be asked to pay 50/= via mpesa for the registration to proceed.

- Go to MPESA toolkit on your phone

- Choose lipa na mpesa

- Tap on pay bill

- Tap enter business number and type 212121

- Tap on account number

- Enter Kenya national ID card number as the account number

- Enter amount Ksh 50

- Now enter your MPESA pin

- Read and confirm the details

- An SMS comes to your phone confirming registration.

Stage 2: checking for the credit status from Transunion CRB from the phone

- Send your three names to 21272

- Enter your national Identity card number

- Choose CC (Credit Status)

- Your CRB status is sent via sms.

A Good remark means you have a positive status while default means you have a negative status (that is you have already been blacklisted)

Other TransUnion CRB Services

| Service | Charges |

| Clearance Certificate | Ksh 2200 |

| Credit Score | Ksh 150 |

| Credit Report | Ksh 650(to get multiple reports in one year) |

| Blacklist Status | Ksh 50 |

| Who Has Blacklisted (you) Me | Ksh 100 |

- You have to register your email on the transunion website.

- You will also be forced to send your Mpesa message after paying to cert@transunion.co.ke to have your clearance certificate sent to you via email.

- The Transunion Nipashe app carries these plus many other services.

Checking your CRB status from the CreditInfo CRB

This service works via email. Contact them on cikinfo@creditinfo.co.ke

Requirements:

- Fill an online credit status request form

- You can file a dispute with them if you feel that the report is erroneous.

- You can call them directly on Tel: +254 20 375 7272 for help

How To Clear with CRB

If you had been listed, you will need to pay all your loans before applying for a certificate of clearance.

As we had seen in the steps, it will cost you shs.2200/-.

If wrongfully blacklisted, talk to the creditor who listed you and try to resolve the issue amicably.

They may however need you to repay your loan(s).

In case you had been listed wrongly, explain that you had never loaned any amounts from them.

Once you agree, ask for a clearance document, scan and then email it to the relevant CRB.

How to check CRB status on phone: FAQ

Q: I found that the lender has shared the wrong information. What should I do?

A: If you feel that the lender who listed you gave the wrong information, contact and file a dispute immediately with the CRB that gave you the report. And If the dispute is not solved within 21 days from the date if filing, that bit of information should be removed from your profile.

Q: Can I be blacklisted because of a sh.1 debt

A: Yes. Some banks and mobile loan apps. can blacklist you for even less than a shilling. To be on the safe side, Always strive to pay off the entire loan amount

Q: For how long will I be blacklisted

A: The negative details on metropol crb and elsewhere will remain on your profile for 5 years.