We love recommending helpful financial inventions and this time I am endorsing the Shika loan app. Well, I have used the app and yes, it’s a wonderful application to borrow from if you want a quick loan.

I was especially delighted by the reasonable interest rates (more on this shortly) and the extremely supportive Shika loan app customer care team.

Now, some users have problems downloading and borrowing from the Shika loan app so we shall go through the Shika loan app download steps.

We shall later look at how to complete the loan application before finally answering a couple of your questions about Shika.

Shika Loan Download and loan application: Step-by-step guide

To download Shika loan app apk, go to Google Playstore and type Shika loan app free download.

The app comes up within seconds.

Click Install.

The app should finish installing in a short while meaning you’re ready to proceed with the Shika loan registration..

Shika loan registration..

First, open the app. (Click Open).

Click Sign up. Agree to Shika app loan terms and conditions by clicking Accept.

Next, type the following information:

- First name

- Last name.

- Your email address.

- ID number.

- Safaricom phone number

- A suitable password (remember to confirm it by retyping the password).

- Lastly, Click Continue.

It’s now time to make your loan application…

How to borrow a Shika loan

Next, you’re prompted to answer some questions including how much you want to borrow from Shika loan app.

Do so and click Next.

You then briefly explain how you will be using the advanced loan. Just type your explanation in the provided space.

Next, click on Complete.

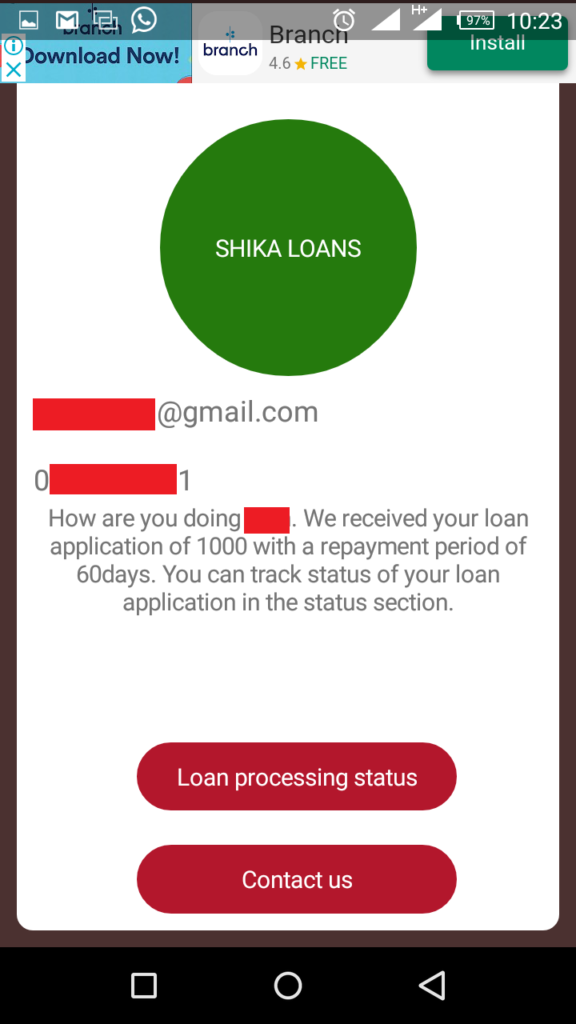

You will immediately receive a notification message on the screen alerting you that Shika has received your loan application.

Click the loan processing status tab or contact us to find out if the company has processed your loan.

How to Request a regular loan from the Shika loan app.

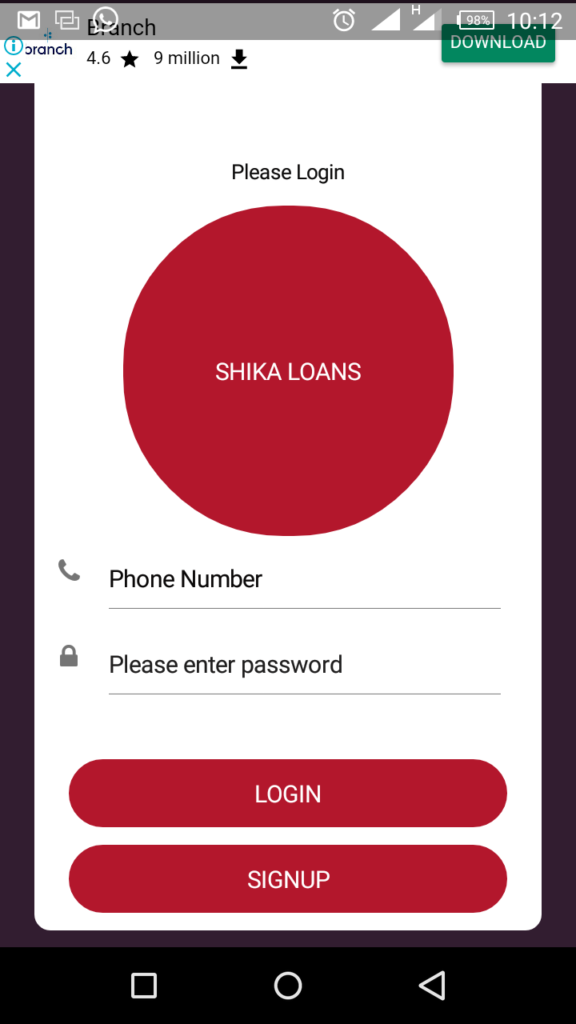

Here are the steps to follow if you already have the app and wish to request a fresh loan from Shika:

- Open and Log into the Shika app. You will type your Safaricom phone number and the Shika password on the provided space.

- Click on the Shika menu once logged in.

- Select Request Loan.

- Type your desired amount (within your loan limit)- Note that the app displays your loan limit as soon as you press the Shika loan request button.

- Choose Request.

- Confirm the request and wait.

The cash is soon disbursed to your MPESA.

Shika loan app terms

Here now is a summary of the loan cost and other shika loan terms..

Minimum Starting loan: shs.500. (depends on your credit score and can be higher)

Maximum loan: shs.10000

Repayment period: Up to 60 days.

Shika loan Interest rate (facilitation fee): 15% of the amount borrowed (30-day loans)

Requirements to qualify for a Shika loan

Shika has very minimal preconditions and advances loans to Kenyans from all walks of life.

However, they inspect your latest 3-months MPESA statement to determine if you qualify and how much you can borrow.

They also look at your CRB records to assess your credit risk rating and score.

You may be denied a loan if any of the aggregated factors returns a negative rating.

Furthermore, your loan request might fail if you have been blacklisted by other loan apps/banks due to the higher default risk.

Other conditions:

- Be a Kenyan citizen.

- Have a valid Kenyan ID card.

- Have an MPESA registered telephone number.

How to Pay Shika Loan

You’re typically allowed 30 days to repay your loan.

The app is, however, flexible and you can opt to make daily, weekly, or bi-weekly installments if you find it convenient.

Whichever the method, you must clear your loan before the expiry of the 30 days to avoid being blacklisted.

The team at Shika sends you timely and courteous reminders prior to your due date.

Follow these steps to repay your Shika loan..

If using the app:

- Click on Repay on the App’s Home page

- Click on copy to duplicate the Shika loan Paybill number. The app promptly redirects you to a new screen.

- Click the Repay tab again. The app now sends you to your MPESA toolkit to enable you pay your chosen amount.

Via MPESA:

- Open your Safaricom SIM Toolkit

- Click Lipa-na-M-pesa

- Choose Pay bill

- Type Shika loan paybill number 811655 (or long-press to paste)

- Enter your phone number as account number

- Type the amount to pay.

- Type your MPESA pin.

A confirmation SMS will soon be sent your way confirming your loan repayment.

How to increase your loan limit

The system continuously evaluates your credit limit on a monthly basis depending on the number of loans you have borrowed and your repayment history.

You will certainly earn a loan limit increase over time if you always make timely repayments.

Shika Loan Contacts

If stuck, you can get a helping hand from Shika.

Use the following Shika loan app contacts to ask for help:

- Email: kmutiso@shika-app.com or care@shika-app.com

- Website: https://shika-app.com

If you’re tech-savvy, send them an inbox message or a Direct Message on their social media contacts below..

- Shika Facebook page: https://www.facebook.com/Shikaapp/

- Shika app on Twitter: https://twitter.com/shika_app (@Shika_app)

You can as well press the help tab in your Shika app and write them a direct message.

About Shika Loan App..

SHIKA loan app has been developed by alternative circle and exclusively advances microloans to Kenyans.

The company raises fund from various lenders for onward lending and has a long term goal of helping entrepreneurs access affordable business finance.

Shika has so far attracted over 100000 installations and has a positive rating of 3+ stars implying that most of their borrowers have a happy experience with Shika.

It’s important to build a compelling credit history to access bigger loans from Shika.

Shika App: Frequently asked questions/Help

I forgot my Shika PIN. Help.

To change your PIN, type a wrong PIN three times. The app automatically asks if you’ve forgotten your password/pin.

Choose Yes and key in your e-mail address. The app will send a temporary login/reset code to the provided e-mail address.

Now open your e-mail and note the code. You should use it to log-in to Shika.

You will then be asked to set a brand new password.

Alternatively, to change your PIN/password from within the app, click on settings and click change PIN.

I haven’t received my loan, over 30 minutes later

If this is caused by Mpesa being down or sluggish, your cash will be instantly sent as soon as MPESA services are restored.

The app usually notifies its clients if MPESA is down.

Delays in disbursement can also be due to your internet timing out when submitting your details. You should check your internet connection and retry, to avoid doubts.

You may also contact Shika customer care guys though email. Use the address care@shika-app.com

Shika is constantly saying that it’s reviewing my limit, what can I do?

Well, this is an error that occurs when your smartphone fails to send some information even after allowing the app the necessary permissions.

You should uninstall then reinstall the app to get rid of the issue.

Write to Shika on care@shika-app.com for assistance if the error persists.

What happens if I make late repayments?

Your outstanding loan will be topped up by a further 10% roll-over fee (of the total accrued amount). The penalty will start accruing from the first day after your due date, that is, from the 31st day (from the day you were advanced the loan).

Your name is also added to the CRB database if your loan is overdue by 60 days (from the day of issue).

As you might be aware, this makes it pretty difficult for you to secure loans in Kenya from apps, banks, and SACCOs.

Summary

To get a quick mobile loan from this application, first download the Shika loan APK from Google Playstore.

You then click sign up to type your details before answering a few questions including your desired loan amount.

The rest of the steps are straightforward and your loan should be credited to your MPESA within a couple of minutes.

OTHER LOAN APPS:

Timiza Loan App: How to get an Instant MPESA Loan(lowest rates)

Okolea Loan App: How to get upto shs.250000 instant loan

Stawika Loan App: How to get an MPESA loan in 5 minutes

Tala Loan App instant MPESA loans: step-by-step guide

Haraka loan application: Instant MPESA Loans [Step-by-step]

Zidisha Loan App: Downloading and loan application guide