Like with other loan apps in Kenya, Okolea loan application is straightforward and you should receive your cash instantly via MPESA.

Here are the easy steps you should complete when making your okolea loan application.

Typically, Okolea releases the funds within minutes – unless you miss a step.

Okolea Loan Application: step-by-step guide (3 simple steps)

Step 1: Download okolea app

To begin with, download the okolea app from Google Playstore.

Just open Google Playstore in your phone and search for the app.

To quickly find the app, type okolea loan app download in the Playstore search window then allow a few seconds.

Next, click Install immediately the app comes up.

Note that Okolea will request certain permissions, for instance, SMS and location access when downloading.

You should accept the permissions request since the app relies on your phone data to calculate your loan limit.

Step 2: Register on the Okolea Loan app.

You will need to create an account after downloading the okolea loan apk.

To do this:

- Click Open (to launch the app).

- Select next.

- Select next again (Accept all the requested permissions).

- Click

- Now tap on sign up.

- Enter your registered Safaricom mobile number.

- Select next again

- You type your details next- first and last name, your email address, and National ID number then choose

- Proceed to type your exact date of birth (ignore the reference code), county, gender, occupation (employed or self-employed).

- Select nex

- Type a good password then confirm it (must be at least 6 characters).

- Click

That’s all. You have successfully registered to be a member okolea international app.

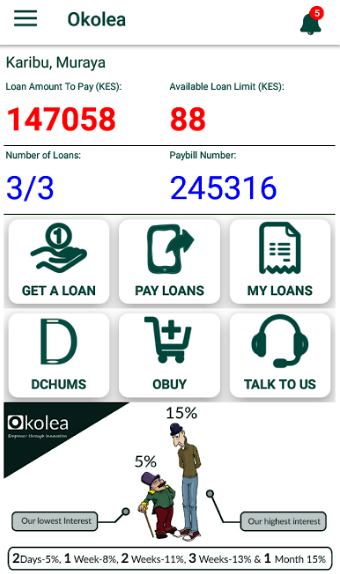

The app immediately computes your first allowable loan amount and displays it in the screen alongside other information.

Step 3: Request Loan

You last and most exciting step in the Okolea online loan application is to request for your desired loan.

To get the loan, tap on the get a loan tab.

Okolea will demand that you give it consent to check your CRB report. Click allow otherwise it won’t progress beyond this stage.

Click finish.

The remaining steps are effortless and the cash should be sent to your MPESA in a couple of minutes.

Can you see how Eaaaaaasssy the Okolea loan application process is?

Note that the company might delay in releasing your funds if you’re applying at night.

But you have little to worry about as the money is sent first thing early the next morning.

Okolea loan Interest rates and other terms

It’s vital that you know about the loan cost and other conditions even as you complete your Okolea loan application.

Now, the company has one of the best interest rates in the market. In fact, your loan will cost you pretty little especially if you select a shorter repayment period.

Here are the official Okolea loan interest rates:

| Loan term | Applicable interest rate |

| 2 days | 5% |

| 7 days | 8% |

| 21 days | 13% |

| 30 days | 15% |

Note that there are apps which levy as much as a 25% interest on loans so Okolea is quite favorable.

Okolea loan app requirements

Okolea loans are open to every Kenyan and all you need to do is fill in the details I explained above in the Okolea loan application.

But:

- You must be a Kenya resident.

- You must have a Safaricom number.

- You must be in a position to repay (Have a good credit score).

Again, Okolea won’t advance you loans if you have been blacklisted by CRB because of defaulting on loans you previously borrowed elsewhere.

How much can you borrow: Okolea loan limit

Another reason why I love Okolea is their reasonable beginner loan amount..

Well, the minimum they give you usually depends on your MPESA activity and myriad other factors but overall, they might start you at a significantly higher amount.

For instance, I was advanced shs.5000 first time I borrowed from Okolea (There is an app that was awarding me shs.100 at that time!)

Having said that, their lowest loan is shs.500 while the maximum is a whopping shs.250000.

What’s more, the microfinance automatically reviews your loan limit upwards by 20% after every cycle of Okolea loan application and timely repayment!

And as you might have noted, they allow a 30-days repayment period.

OKOLEA loan app repayment steps and Okolea loan pay bill number

To repay your loan..

- Open your Mpesa Menu

- Click Lipa na Mpesa

- Select Paybill

- Enter 245316 (Official Okoloa loan app paybill number)

- For the account number, enter your Okolea registered Safaricom phone number.

- Enter the amount to repay

- Type your Mpesa pin and press OK.

Okolea soon sends a confirmation SMS to your phone.

Alternatively:

Open the Okolea loan app. and select the Repay Loan option.

The Okolea app advantage

Unlike most of the rival loan apps, Okolea allows you to borrow afresh even before paying off your outstanding loan.

For example, you can have a shs.1500 Okolea debt.

But then you find yourself in yet another financial emergency…

Now, if you have Okolea installed, just open the app and make a new Okolea loan application your desired amount.

You will again be credited with a new loan provided you’re still within your loan limit.

In fact, you can have 3 different Okolea loans at the same time.

Believe it or not, rarely do other loan apps allow this.

Tips to help you grow your Okolea loan limit

As I mentioned earlier on, Okolea regularly raises your loan limit by 20% after every successful timely loan repayment.

Subsequently, the best way to qualify for bigger loans from Okolea international is by repaying your loans ahead of their due date.

In addition, try to borrow from them regularly to attract frequent loan limit increments.

Okolea Loan Contacts

- Okolea Customer-care telephone number: 0742-817221 /0743-392499 / 0709-615000

- Okolea Email address: support@okolea-international.com

- Okolea Facebook page:https://web.facebook.com/OkoleaInternational/

- Okolea Twitter handle: @Okoleaint

- Main website: https://okolea-international.com

- Okolea on Instagram: visit Okolea apps’ instagram page

Okolea app update

It’s advisable that you update your app regularly to continue enjoying its latest features and improved security controls.

Here is how to update your app..

- Open the Google Playstore.

- Go to the menu and click my apps & games.

- Look for the Okolea loan app and tap on the Update icon, if available. Your app is however updated if the update option is unavailable.

About Okolea app.

The app is the property of Okolea international company; a fully registered fintech operating in Kenya.

It exclusively offers emergency loans to Kenyans from all walks of life and has served over 260000 clients as of today.

The app is built for Android phones and disburses cash via MPESA.

The app has been given an average score of 3+ by its users on Google playstore meaning that most are satisfied with Okolea loans.

Okolea loan application: Frequently asked questions

What if I don’t pay back my Okolea loan?

Well, your details will be forwarded to CRB meaning you’ll face immense difficulties borrowing from other apps and banks as well as to Okolea international company debt for further action.

Am I guaranteed a Loan?

In most cases, yes.

But be sure to give truthful information and to allow okolea to read your Mpesa messages and CRB information for efficient loan processing.

Wrapping it up

Okolea loan app offers emergency loans at favorable terms.

Your first step in making an Okolea loan application is downloading and installing the okolea loan app apk.

You then register by typing in a few details before clicking get a loan.

Use the above-listed Okolea loan app contacts to get help from their customer support team if stuck.

Good luck and remember to pay back your loan on time.

I nearby to help me business loan.During this time I need you request of my application.yes I will be lucky faithfully.

I nearby to help my business during this tim

I want to use as my bill to pay my hospital bill