Last updated on March 13, 2021

So, a lot of people ask “why is my tax refund negative” and today, I want us to answer that question. Specifically, I want to talk about how to claim refund from kra.

Now, if when filing kra tax returns you get a negative amount, it means that you have overpaid your tax and that KRA should refund the excess amount.

The converse of this is true: if the value is positive, you owe KRA and you should make the necessary payment.

Here is how to claim refund from kra using the kra claim form:

Note that the kra refund process is the same whether for kra paye refunds and kra income tax refunds.

How To Claim Refund From Kra: The Steps

Steps 1: Log in to KRA Itax using your usual KRA PIN number and password

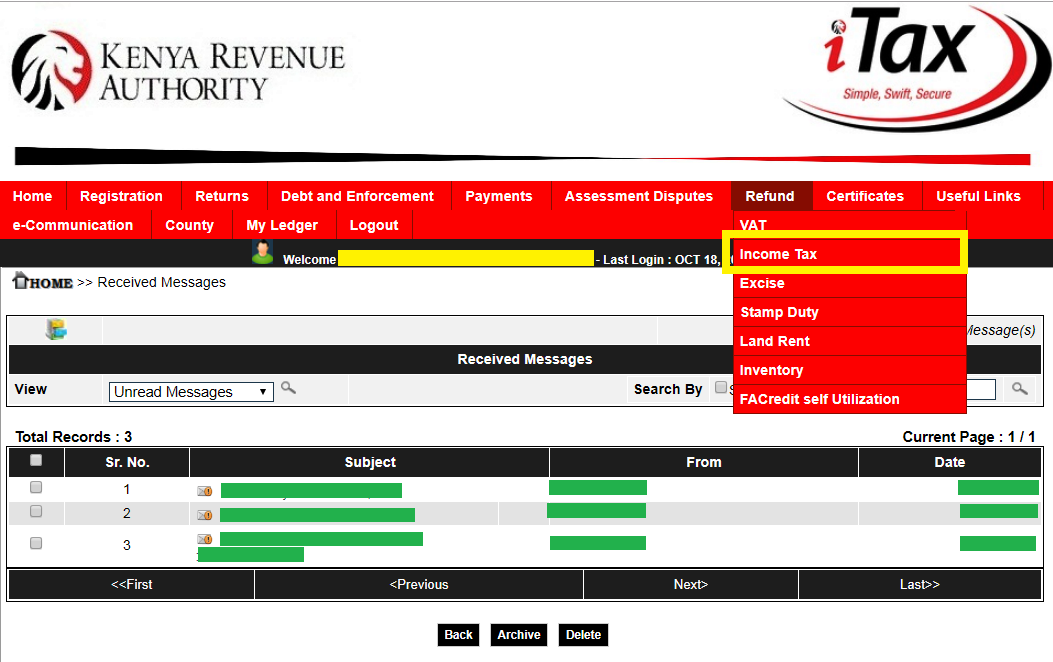

Step 2: Point to refunds and choose the applicable type of kra refund application. E.g. if its income tax refund, you select the income tax and fill in all the mandatory sections.

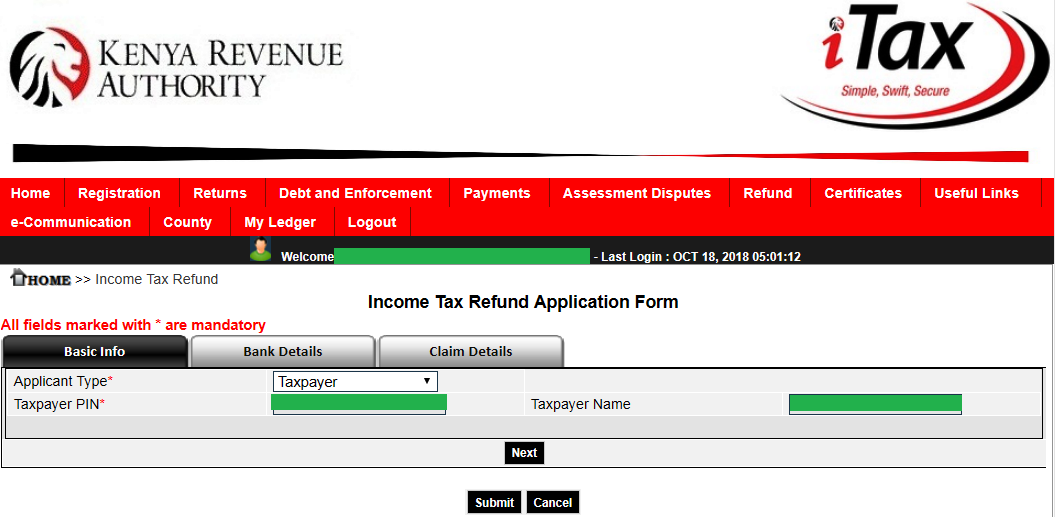

Complete your kra refund form with the basic information, Bank details where you want the money wired, and lastly the reason why you want to be refunded, Refund Type, e.g. normal, and a description plus, of course, the amount.

Step 3: Submit your request by clicking the submit button.

What next:

You will soon receive an Acknowledgement Receipt number for your Refund application. Save it as you may need to use it when calling KRA customer care numbers as you follow up.

How long do KRA refunds take?

According to KRA’s website, all refunds are processed within a maximum of 90 days after you submit the application for ‘normal’ refunds and about 60 days for traders requesting withholding VAT refunds.

How If I don’t Get Any Communication?

The KRA staff is very friendly and you can call them on 0711 099 999 or write an email to: callcentre@kra.go.ke. Quote the Acknowledgement Receipt number in all your application.

What If They Have Not Refunded Me By the Next Filing?

If KRA hasn’t yet processed your refunds including vat refundable by the time you are filing again, no worries. The amount will be automatically deducted from your due tax so you can’t lose your hard earned cash.

Final Thoughts On How To Claim Refund From Kra

There you have the answers to the question how to claim refund from kra. As you have seen, having your negative tax due paid is pretty easy. Don’t hesitate to seek assistance from Huduma center, your cyber café guy, or the nearest kra tax stations if you have problems with the kra portal.

KRA is rendering excellent work.Keep up

Sure. Thank you for reading