Last updated on February 1, 2023

Have you considered investing in the CIC investment plan but are unsure how to proceed? Here’s a quick guide on how to join CIC money market fund.

The CIC Money Market Fund has one of the best annual yields, and it can be a great option if you’re looking for a good money market fund to invest your idle cash in (instead of leaving it in your bank savings account, earning next to nothing).

Besides that, it is a low-risk fund that invests in both diversified near-cash investments and high-quality interest-bearing investments such as fixed cash deposits.

In addition, the Capital Market Authority (CMA) licenses and regulates the fund.

With that in mind, below is how to join CIC money market fund.

How to Join CIC Money Market Fund

Here is a step-by-step guide on how to join CIC money market fund.

Before we begin, please ensure that you have the following documents:

- a copy of your ID or passport.

- a copy of KRA certificate.

- a passport-sized photo.

- Bank details.

Otherwise, the process is done fully online and therefore there is no need to meet an agent or go to any offices.

- Log in to the CIC online self-registration portal.

- Once there, navigate to the top on your right and click on “self-service portal.”

You will be directed to log in page.

Click on the “invest” tab on your right, and then choose your preferred joining type i.e. individual, joint, or corporate.

In this case, select “Individual member.”

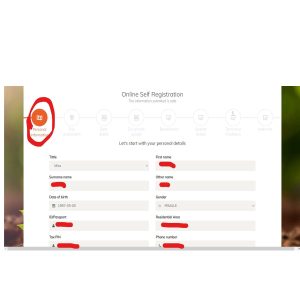

- Now, fill the application form starting with your personal details i.e. your name, date of birth, gender, ID/passport number, residential area, KRA Pin, phone number, email, and postal address.

- Next, complete the risk assessment survey test to calculate your risk profile.

- After that, you will be asked to fill in your bank details as shown below.

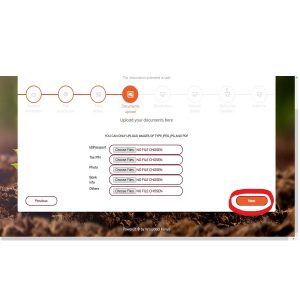

- Now, it’s time to upload the required documents i.e. Id/Passport, KRA Pin certificate, passport photo, and the front page of your bank card.

Quick note: Scanned copies of the documents or clear photos are acceptable.

- You’re not yet done and now you are asked to key in your beneficiary’s details.

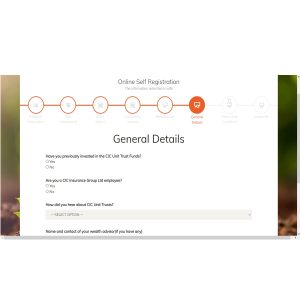

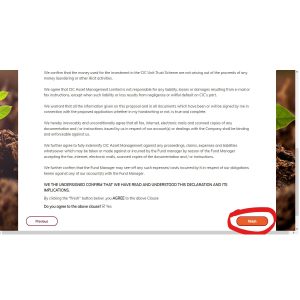

- Next, fill the general details displayed on the next page, then proceed to accept the terms and conditions

Upon completion, submit your application by clicking on the “Finish” button and wait for a response from CIC with your membership details.

Later, CIC will send you an email with a welcome letter (the free CIC Beginners Guide) and an SMS with your member number (your CIC Unit Trust account will be created within 24 hours).

In addition, the application form allows you to request a callback from CIC to confirm the opening of your CIC Unit Trust account.

Fill out your information at the bottom of the log-in page to request a call back.

Important: When filling out the application form, make sure you provide accurate information.

Alternatively, you can download the CIC Unit Trust Account Opening Form from the online portal, fill it out, attach the necessary documents, and email it to cic.asset@cic.co.ke.

However, if you do not want to register online, you can visit any CIC offices in Kenya and fill out the application form by hand.

Here are their locations across the country. Feel free to visit any of these branches for more guidance.

How to deposit money to CIC money market fund

You can always top up through Mpesa paybill (600118) or bank transfer (i.e., Co-operative Bank, Account Name: CIC Unit Trust Collection Account, Account Number: 1122190806600, Branch: Co-operative House, Branch Code: 11, and Swift Code: KC00KENA).

The minimum top-up to the CIC money market fund is Kshs. 1,000, but you can top up with any amount and as often as you want as long as it is Kshs. 1000 or more.

After you have opened the account, you can now deposit funds into it using Mpesa paybill 600118 as follows:

- Go to the Mpesa menu.

- Select “Lipa na Mpesa” from the drop-down menu.

- Select Pay Bill.

- Enter 600118 as the business number.

- For the account number, enter your MEMBER NUMBER. However, the MEMBER NUMBER should be followed by the first letter of the fund. To top up your Money Market Fund, for example, enter your member number and then M.

- Enter the amount to be paid (there should be no commas).

- Enter your Mpesa PIN and then press OK.

After that, you’ll get an SMS confirming the transaction.

It is worth noting that the initial minimum investment is Kshs. 5,000, and the additional deposit is Kshs. 1,000.

In addition, you can top up your account with the CIC Asset App, which is available on both the Google Play Store and the Apple App Store.

- Log in to the CIC ASSET app.

- On the home screen, select the “Top-up” tab.

- Enter the deposit amount.

- Choose the account to be topped up (in this case, the CIC money market fund).

- Select a payment method (Mpesa).

- Click continue.

- You will receive payment summary information as well as a pop-up notification to enter your Mpesa PIN to authorize the transaction.

- To finish the transaction, press the “OK” button.

Both CIC and Mpesa will send SMS notifications upon successful fund transfers.

CIC money market fund interest rates

Currently, the CIC interest rate on all deposits is 9.5% per annum.

However, CIC interest rates have consistently been 8% p.a. over the last few years, which is quite impressive.

Note: It’s important to remember that interest rates fluctuate based on the performance of the underlying investments.

How to get your CIC money market fund statement

Here’s how to access your statement via the online portal:

- Log in to the CIC Online service portal using your member number and password.

- Enter the four-digit OTP sent to your phone and press the “verify OTP” button.

- Tap “Accounts” on the dashboard’s left side.

- To generate your statement in PDF format, click the “View Statement” button. You can as well download the statement as a PDF.

Just so you know, the end-of-month statement is mailed to you by the fifth of the following month.

What you need to know about CIC money market fund withdrawal

Before you withdraw your money, you should be aware of the following facts:

- The minimum balance in your account should be Kshs 5,000.

- You can only withdraw once per month; if you withdraw more than once, you must pay Kshs. 1000.

- It is very important that you provide your member number, account number, and email address.

There are two ways to request a withdrawal of your funds.

1. Using the CIC Asset app

- Launch the CIC Asset app.

- Click the “withdrawal” button on the menu.

- Enter the amount to be withdrawn.

- Choose the account that you want to debit (i.e., the money market fund).

- Choose a payout method, such as bank transfer.

- Confirm your bank account information.

- Enter the six-digit code sent to your phone number via SMS.

- Confirm withdrawal request.

Once your account has been debited, you will receive an email and an SMS confirmation.

Note:

- Withdrawal requests received before 9:00 a.m. are processed the same day, and funds are transferred to your bank account within 2 to 4 days.

- Individual and joint accounts with a “one to sign” mandate are the only ones that can make online withdrawals.

2. By sending an email

You can send an email to CIC indicating that you want to withdraw a specific amount of money and including your member number, bank account information, and the amount you want to withdraw. The email should then be sent to cic.asset@cic.co.ke.

How to join CIC money market fund – FAQs

CIC Money Market Fund contacts

Facebook: CIC Group PLC

Website: www.cic.co.ke

Telephone number: +254 703 099 120 0r +254 703 099 322 or +254 020 282 3000

Email: cic.asset@cic.co.ke or callc@cic.co.ke

Final words on how to join CIC money market fund

That is how to join CIC money market fund, as demonstrated above.

Become a member today and begin investing to reap the benefits of the fund.

Among the numerous advantages are:

- Liquidity: You can withdraw your money without penalty at any time.

- It is a versatile fund strategy because you can switch or transfer funds from the CIC Unit Trust Fund account to another.

- In the Kenyan market, CIC Money Market Fund provides competitive and consistent returns.

Happy investing!

Also Read:

Which is the best money market fund in Kenya?

Best investment companies in Kenya and opportunities offered.

Best companies to invest in Kenya (in the short term and long term).

Be First to Comment