Are you aware of the deception tactics employed by Mpesa fraudsters? If not, continue reading to find out how Mpesa fraudsters operate.

Mpesa is a widely used mobile money transfer and payment service in Kenya, provided by Safaricom.

While Mpesa has provided many benefits to Kenyan users, it has also attracted the attention of fraudsters who attempt to take advantage of unsuspecting individuals and system vulnerabilities.

So, if you are not aware of their schemes, you may easily fall into their trap and be duped out of your hard-earned money.

It is therefore critical to understand the tricks used by fraudsters in order to avoid falling for their schemes.

Hence, in this article, we will look at how Mpesa fraudsters operate in order to keep you alert.

Let’s get started…

How Mpesa fraudsters operate

Here are some of the most common methods used by Mpesa fraudsters to defraud you as a regular Mpesa user as well as an Mpesa agent:

How Mpesa fraudsters con regular Mpesa users

1. SIM-card swapping

Fraudsters can replace and take over your mobile phone line without your knowledge.

Remember that SIM card swapping simply refers to the transfer of network from one SIM card to another.

This typically occurs when a fraudster contacts your mobile phone’s carrier and dupes them into activating a SIM card that they own (they will impersonate you, claiming that the SIM card has been lost or damaged).

By doing so, all information is transferred to the new SIM card, where the fraudster can access everything, including your Mpesa account details.

Once the fraudster has your phone number, they will have easy access to your Mpesa account and will be able to conduct fraudulent transactions.

Fortunately, you can protect yourself from SIM card swapping. All you have to do is make sure your SIM card has an active SIM lock and that you use strong passwords.

2. Fake promotions or prizes

Fraudsters may send you messages claiming that you have won a prize or that you have won a promotion.

They will then ask you to provide personal information or make a payment in order to claim the prize, but this is all a scam designed to steal your money or sensitive data.

So, if you are not cautious, you may end up being duped.

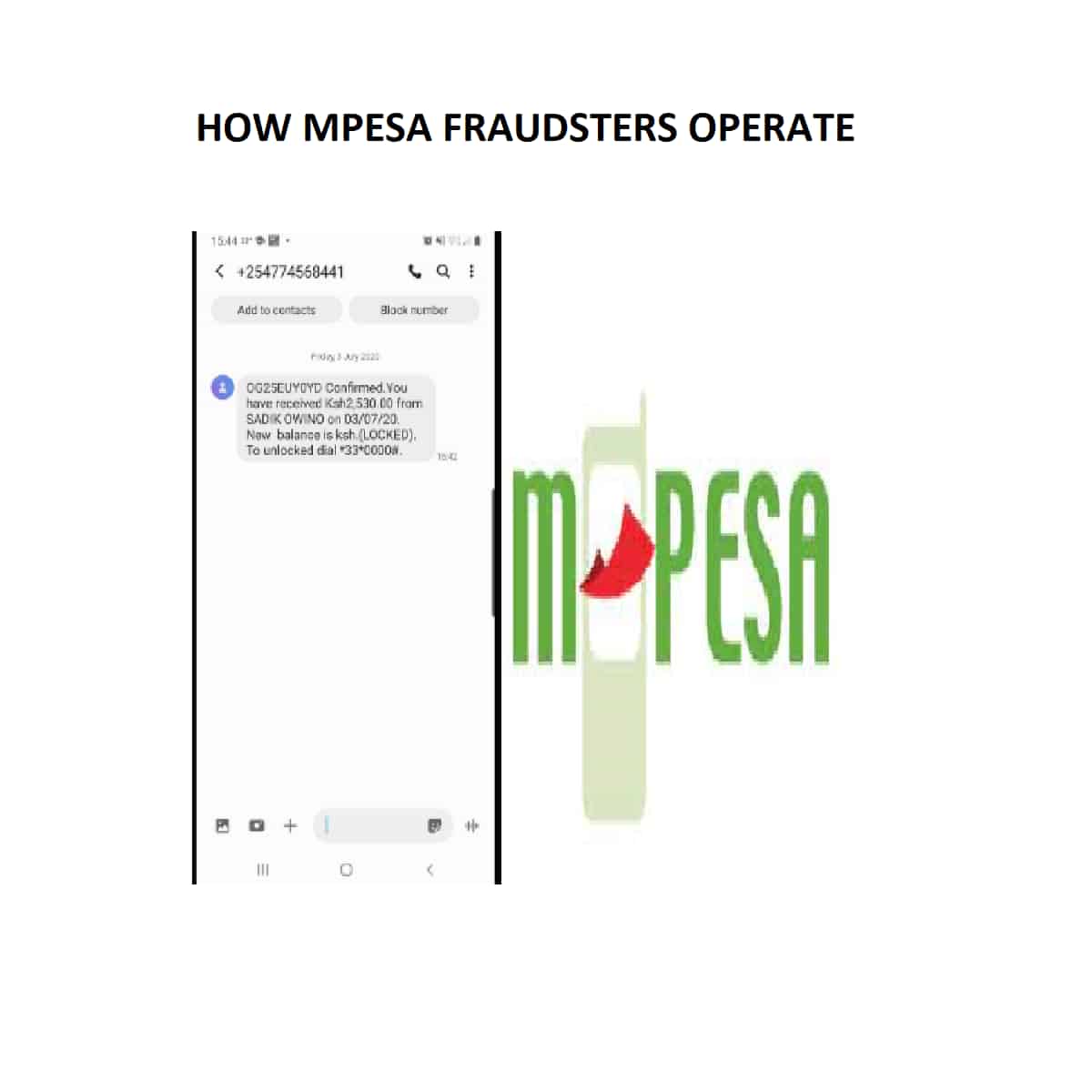

3. Fake reversal instructions

Fraudsters can also deceive you and gain unauthorized access to your Mpesa funds by using fake Mpesa reversal instructions as part of their scamming tactics.

Here’s how it works:

- You will receive a ‘fake’ Mpesa message informing you that you have received a certain amount of money from someone, but your new Mpesa balance will read “LOCKED.”

- The fraudster will then contact you, falsely claiming that there was an error in the transaction and insisting on a reversal.

In order to appear legitimate, the fraudster will impersonate an Mpesa agent or a Safaricom customer service representative.

- The fraudster will then instruct you on how to initiate the reversal process.

These instructions typically request that you perform actions on your mobile phone, such as sharing personal information, providing sensitive account information, or performing additional transactions.

- The fraudster will gain access to your Mpesa account by tricking you into sharing personal information or performing specific actions, allowing them to make unauthorized transactions from your account.

It is important to note that a genuine Mpesa message is sent from Mpesa and not from a customer’s line.

However, instead of refunding the money as directed, request that the sender forward the message to 456 and wait for Safaricom to reverse the transaction.

4. ‘Tuma kwa hii number’ scam

This is also one of the most common scams in Kenya.

Unfortunately, many Kenyans have fallen victim to this scam, sending money after receiving distress messages from family, friends, or acquaintances.

Typically, the messages are designed to create a sense of urgency and to manipulate your emotions.

For example, the fraudsters creates a message informing you that your child at school is in an emergency and has been rushed to the hospital, and they request that you send money immediately.

They then send the message to thousands of random numbers, and because the chances of parents with children in school are quite high, this is how they almost always succeed.

In order to protect yourself from such scams, you must remain vigilant and take the following precautions:

- Be cautious of disclosing personal information, transaction details, or Mpesa PINs to anyone, especially those who contact you unexpectedly.

- Always confirm the authenticity of any communication purporting to be from Safaricom or another trusted entity. To confirm the authenticity of any requests or instructions, contact Safaricom’s official customer service channels directly.

- Avoid rushing into transactions or sharing sensitive information because of a third-party-created sense of urgency.

- Check your Mpesa account on a regular basis for any suspicious activity or unauthorized transactions. If you have any concerns, please contact Safaricom customer service or the appropriate authorities right away.

Keep in mind that Mpesa or any legitimate service provider will never ask for your PIN or personal information via unsolicited calls or messages, so be cautious of these con artists’ schemes.

How Mpesa fraudsters con Mpesa agents

1. Fake transactions

Fraudsters may approach an Mpesa agent and request a transaction that appears genuine.

For instance, the fraudster could forge a transaction message claiming to have withdrawn money from the agent, and because the ‘customer’ has the message, the Mpesa agent will believe there is a delay on their end.

But in reality, the fraudster never withdrew any money in the first place, and the agent loses money from their account as a result.

2. Phishing

Fraudsters may send bogus text messages or emails purporting to be from Safaricom or Mpesa, requesting sensitive information such as account details or login credentials, or instructing recipients to click on malicious links.

Typically, the message contains urgent or alarming content, urging the recipient to respond as soon as possible.

Unfortunately, if a Mpesa agent falls for a phishing scam and provides their login information or account information, the fraudster will gain unauthorized access to their Mpesa account.

3. Use of fake money

Typically, fraudsters will target Mpesa shops that appear to be busy in order to make a deposit, and because you will be in a rush to serve all of your customers, you may end up receiving fake money.

Therefore, always double-check if the cash a customer is depositing is genuine by feeling the texture of the notes or, better yet, use a UV light.

To combat these types of fraud, Mpesa agents must remain vigilant, adhere to security protocols, and proceed with caution when dealing with unfamiliar or suspicious transactions.

They should also double-check transaction details and report any suspicious activity to Safaricom or the appropriate authorities.

Remember that maintaining a high level of awareness and putting in place strong security practices will help protect you and your customers from Mpesa fraud.

How Mpesa fraudsters operate – FAQs

What number does Safaricom call from?

It is important to note that Safaricom’s official phone number is 0722 000 000.

How Mpesa fraudsters operate – Wrap up

So, that’s how Mpesa fraudsters operate.

Mpesa fraudsters frequently employ the tactics listed above to defraud Mpesa users and Mpesa agents.

It is therefore critical to remain vigilant in order to avoid falling into their traps.

And, if you suspect any fraudulent Mpesa activity or have been a victim of such fraud, you must immediately report the incident to Safaricom’s customer service or the nearest police station.

Be cautious!

ALSO READ:

How to deactivate Safaricom line

Be First to Comment